are electric cars tax deductible uk

Extent of charge to tax. Charge to tax on rent receivable for a UK electric-line wayleave.

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

For amounts which would otherwise be deductible.

. Teslas are amongst the most expensive electric vehicles to insure. Meaning of rent receivable for a UK electric-line wayleave 346. Basic UK taxes include income taxes property taxes capital gains UK inheritance taxes and Value Added Tax VAT.

Extent of charge to tax. If the car is leased solely for business purposes then VAT is fully deductible however if there is any personal use then only 50 VAT is deductible. The last element of the definition of a tax-deductible cost was added to reduce uncertainties surrounding the deductibility of business expenses that do not directly generate revenue.

So tax relief for leasing an electric car is given each year depending on the cost and business use contrasted with outright purchase which provides an initial and one-off tax deduction. HM Revenue and Customs HMRC is responsible for administering and collecting taxes in the UK. Chapter 8 Rent receivable for UK electric-line wayleaves.

Issues relating to electric cars. Rated Trips is the brand new place to discover all of the AAs rated and award-winning hotels BBs campsites and restaurants and lots more besides. MoneyGeeks review of 17 EV models found that 3 of the 5 electric cars with the highest insurance costs were the Teslas specifically the Tesla Model Y the Tesla Model X and the Tesla Model S.

United Kingdom 246 United States 256 Foreign currencies 266 Contacts 268. Meaning of rent receivable for a UK electric-line wayleave 279. When it comes to leasing a new car whether you should or shouldnt make a down payment depends on your individual situation.

Chapter 9 Rent receivable for UK electric-line wayleaves. The basis of the charge is to tax a figure calculated by multiplying the cars list price by an emission-based percentage often referred to as the appropriate percentage. The British tax system.

The CIT law provides a list of items that are not deductible for tax purposes even if the items meet the general conditions described above. Finance is the study and discipline of money currency and capital assetsIt is related with but not synonymous with economics the study of production distribution and consumption of money assets goods and servicesFinance activities take place in financial systems at various scopes thus the field can be roughly divided into personal corporate and public finance. For 2022-23 you pay 2 company car tax on electric cars which is great news if youre considering a hybrid lease or an electric car lease deal.

Tax receipts for the UK totaled approximately 5845 billion in 202021 a decrease of 77 from the previous tax year. Advice from BAI Personal Tax International. They would be capitalized.

The new child tax credit was made fully refundable in 2021 and increased to up to 3600 per year per child through age 5. Charge to tax on rent receivable for UK electric-line wayleaves. Charge to tax on rent receivable for a UK electric-line wayleave.

Generally the more your car costs the more expensive it is to insure this is part of why Tesla premiums. Motor cars 5 years Straight-line method 20 Other methods and rates could be used if supported by. Anyone who makes a tax-deductible donation to CORENAs operational fund by 30 June 2022 will have their donation matched dollar-for-dollar up to a total of 15000 by a generous long-term.

Child tax credit. Pursuant to income tax law improvements are not deductible as expenses in the year of accrual. Postal Address 16 The Mall Surbiton KT6 4EQ.

Chapter 9 Post-cessation receipts. Nevertheless from 6 April 2020 new company car tax rules have significantly reduced the tax payable on environmentally friendly vehicles such as electric and hybrid cars. London Office 40 Gracechurch Street London EC3V 0BT United Kingdom.

A down payment doesnt help you save money on the overall cost of a lease like it does for an auto loan. Charge to tax on rent receivable for UK electric-line wayleaves. Pietermaritzburg Office 39 Hilton Avenue Hilton KwaZulu-Natal South Africa 3245.

The federal government offers tax credits up to 7500 for purchasing certain makes and models of electric cars and SUVs. Residence or employment in the United Kingdom. Manchester Office 3 Piccadilly Place Manchester M1 3BN United Kingdom.

27 87 551 3130. In addition to driving a low emissions vehicle you can also reduce the amount of company car tax you pay if. What are the benefits of driving electric vehicles.

Road Tax Company Tax Benefits On Electric Cars Edf

Electric Car Per Km Cost Off 65

Electric Vehicles Face Lingering Challenges How Are Startups Helping Early Metrics

2022 Electric Vehicle Ev Index Knowhow

Electric Vehicle Markets Have Their Ups And Downs 2014 Ytd Update International Council On Clean Transportation

Electric Car Per Km Cost Off 65

Purchase Subsidies Zero Rate Tax And Toll Free Travel How To Incentivise Emobility Skoda Storyboard

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Tax On Electric Company Cars In Belgium Ecovis International

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

Ev Car Maintenance Cost Off 64

2023 Is Supposed To Be The Year Of The Electric Vehicle Now Is The Time To Invest Protocol

Russia Cancels Import Tax For Electric Cars In Hopes Of Enticing Drivers Bellona Org

The Tax Benefits Of Electric Vehicles Saffery Champness

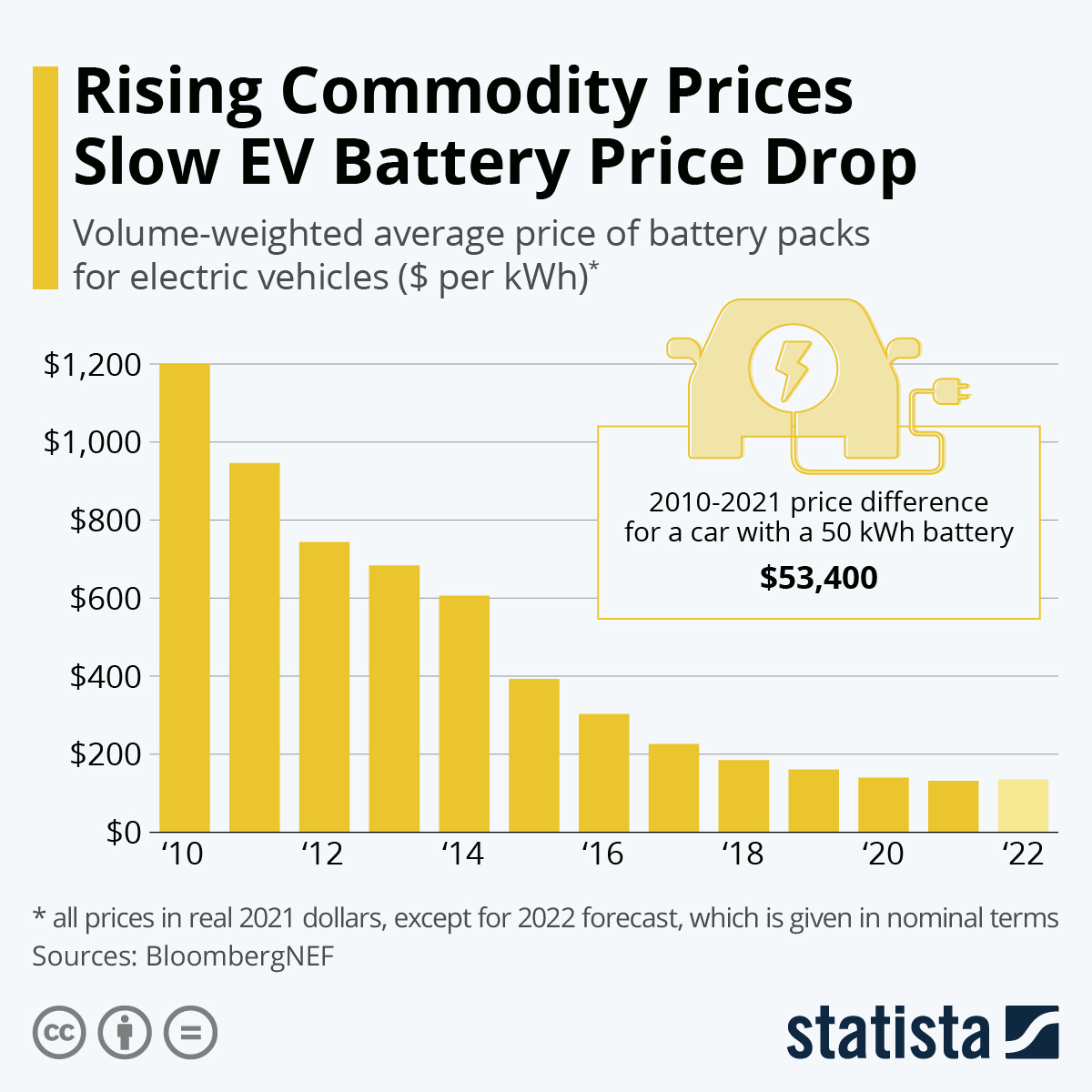

Electric Cars Will Be Cheaper To Produce Than Fossil Fuel Vehicles By 2027 Automotive Industry The Guardian

The Tax Benefits Of Electric Vehicles Taxassist Accountants

How Governments Can Encourage Adoption Of Battery Electric Vehicles Kearney

The Uptake Of Plug In Hybrid Electric Vehicles In Europe S Company Car Fleets Trends And Policies International Council On Clean Transportation

Ev Ev Charger Incentives In Europe A Complete Guide For Businesses Individuals